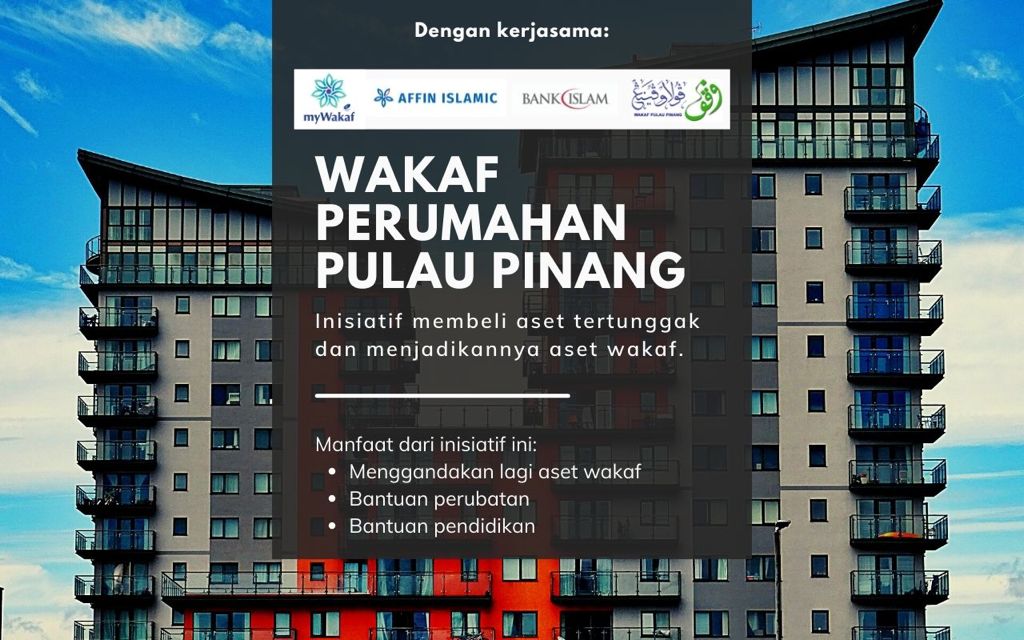

Housing Waqf

Pulau Pinang, Malaysia

- Collection Goal

RM300,000.00

-

Collection Raised

RM224,799.19

Sector

Investment

Purpose

To acquire completed residential property via private treaty from financially distressed individuals (e.g. individuals who are no longer capable to continue paying instalments to their creditor). The property will be declared as waqf under the state’s Islamic religious Council and will be leased out on long-term basis.

The long-term lessee will pay the lease amount upfront which may be via obtaining a banking facility. The lease amount will be used to acquire another residential property and the same process will be repeated (a portion from the lease amount will be used for immediate distribution for educational or health/medical assistance)

Impact

This project is expected to produce impacts as below:

1. The acquisition of property would lessen the burden of the distressed owners from their indebtedness and they would be able to realign their affordability.

2. The conversion of the acquired residential properties into waqf properties would provide housing ownership opportunities for others in form of long-term lease.

3. The repeated process would multiply waqf properties ownership in a developed state like Penang. In identifying the property, priority is given to distress properties in urban area.

4. The proportioning of certain amount for educational or health/medical assistance would be able to provide periodic and immediate assistance towards those causes involving various beneficiaries. This becomes an ancillary benefit towards the society under this project.

Breakdown Cost

| No | Item | Cost (RM) |

|---|---|---|

| 1 | Acquisition | 250,000.00 |

| 2 | Legal and other acquisition fees | 20,000.00 |

| 3 | Repair | 30,000.00 |

| Total | 300,000.00 | |

Kick off Date

12 November 2020

JMC Members

Chairman

YB Dato' Ir. Haji Ahmad Zakiyuddin Abdul Rahman - Yang Dipertua, Majlis Agama Islam Negeri Pulau Pinang

Deputy Chairman

Ustaz Mohd Nazri Chik - General Manager, Strategic Relation, Bank Islam

Committee Member

1. Ustaz Rosidi Hussain - General Manager, Wakaf Pulau Pinang Sdn. Bhd.

2. Huzaimi Ghazali - Pengurus Baitulmal, Majlis Agama Islam Negeri Pulau Pinang

3. Ustaz Mohd Faiz Rahim - Head, Shariah Supervisory, Affin Islamic

4. Rosli Suparlan - Senior Relationship Manager, Strategic Business Alliance, Northern Region, Affin Islamic

5. Abdul Ghani Abd Wahab - Senior Deposit Manager, Northern Region, Bank Islam