- Bank Negara Malaysia (BNM) under the Financial Sector Blueprint 2011-2020 outlines the need of financial inclusion to empower the communities with banking services.

- myWakaf is an inclusive economic instrument that based on philanthropic value in order to achieve its objective; best serve all members of society particularly the underserved, to have an access of quality essential services and assistant in fulfilling their needs towards shared prosperity.

- Waqf, under the purview of State Islamic Religious Council (SIRC) is an important tool of financial inclusion and economic growth. To maximize its potential, Waqf needs to be managed efficiently and professionally.

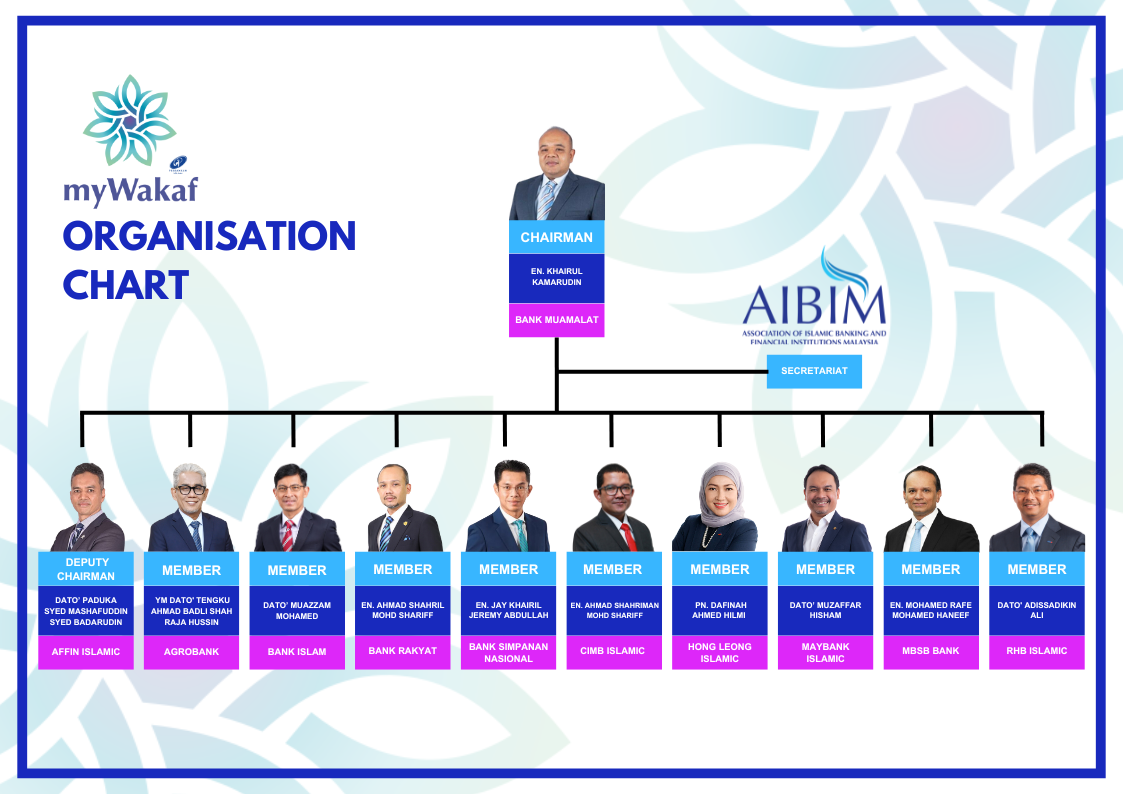

- Bank Negara Malaysia (BNM) through the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) has called for Islamic Banks’ participation in collaborating and standardising Waqf Fund initiative action plan between Islamic Banks and SIRC in developing the potential of Waqf and empower the economy of ummah in Malaysia. Currently, there are ten Islamic Banks have been involved in the implementation of Waqf which consists of Affin Islamic Bank Berhad, Bank Islam Malaysia Berhad, Bank Muamalat Malaysia Berhad, Bank Rakyat, Bank Simpanan Nasional, CIMB Islamic Bank Berhad, Hong Leong Islamic Bank Berhad, Maybank Islamic Berhad, MBSB Bank Berhad and RHB Islamic Malaysia Berhad.

| SIRC | ISLAMIC BANKS |

|

|

The Waqf Fund is a pool of monies from endowment of individuals and corporations aims to be utilized for the perpetuity of the principal and at the same time, generates income to be used for the benefits of the society. The implementation of Waqf Project includes of the followings criteria:

- Immediate economic impact to the ummah (outcome based).

- “Value proposition” to attract non-tradition Waqf Contributors.

- Decision to be made by the Joint Management Committee.

- Existing SIRC’s Projects that meet new criteria or projects identified.

- Create success story within three years of launch.

The execution will be through agreed projects within the following sectors:

Education

To manage, provide or finance in educational or research efforts, such as in:

- facility/ infrastructure/ equipment

- research/ learning/ training

- scholarship or financial assistance

Health and Healthcare

To manage, provide or finance healthcare related efforts:

- medical infrastructure/ equipment

- medical treatment/ services

Investment

To manage waqaf investment in property and financial instrument:

- fund raising activities

- property investment

- financial instrument

Community Empowerment

To manage, provide or finance community empowerment efforts such as in:

- Business startup

- Existing business

This Code of Governance and Transparency for Waqf Fund is formulated to assist and provide guidance to the IBs to adopt good practices in dealing with the management of the waqf fund. The objectives of this Code are as follows:

- to facilitate the orderly development and operationalisation of waqf fund that are consistent with the Shariah requirements;

- to establish a strong oversight process in order to safeguard the interest of the participating IBs, SIRCs and other stakeholders;

- to outline the prudential requirements in order to support sound risk management of waqf fund, which is consistent with the IBs risk management policy and strategic intent; and

- to set out the minimum disclosure requirements that will instill public confidence and facilitate informed decision making by the JMC.

For details, please click here.

myWakaf Objective

To have a dynamic and synergistic relationship between SIRCs and Islamic banks to spearhead innovative waqf related development.

To embark on waqf project that fulfill the needs of identified community with a proper and transparent governance on fund distribution.

To widen waqf collection for the identified communities via banking channels.

myWakaf Logo

myWakaf logo is an elegant logo that harks at Islamic design. The colours are soft and subdued cool tones to reflect a calm spiritual mood. The design is akin to the cross section of a corn which reveals the 7 petals as mentioned in the Quranic verse on the parable of those who spend their wealth in the way of Allah as the following:

“The parable of those who spend their wealth in the way of Allah is that of a grain of corn: it growth seven ears and each ear hath a hundred grains. Allah giveth manifold increase to whom He pleaseth; and Allah careth for all and He knoweth all things.” (Al-Baqarah: 261)

Corporate Information

| No. | Institutions | Name | Status |

| 1 | Affin Islamic Bank | Mohd Faiz Rahim | Main |

| Akmal Asyraf Ab Jamal | Main Support | ||

| 2 | Agro Bank | Nazirul Mustaqim bin Mohd Fauzi | Main |

| Abdul Fatah bin Aziz @ Abdul Aziz | Main Support | ||

| 3 | Bank Islam Malaysia Berhad | Mohd Nazri Chik (Chairman) | Main |

| Mohamad Faiz Ibrahim | Main Support | ||

| 4 | Bank Muamalat Malaysia Berhad | Zaharuddin Alias | Main |

| Wan Nuraihan Hj Ab Shatar | Main Support | ||

| 5 | Bank Rakyat | Mohd Zamerey Abdul Razak | Main |

| Wan Mohd Nahar Othman | Main Support | ||

| 6 | Bank Simpanan Nasional | Anuar Elias | Main |

| Izzuddin Abdussalam Hamid | Main Support | ||

| 7 | CIMB Islamic Bank Berhad | Ken Mohamed Faiz Kamal | Main |

| Mohd Zaid Othman | Main Support | ||

| 8 | Hong Leong Islamic | Akmal Solihi Mohd Yazid | Main |

| Muhammad Munir Zamzuri | Main Support | ||

| 9 | Maybank Islamic | Munawwaruzzaman Mahmud | Main |

| Kamilah Ariff | Main Support | ||

| 10 | MBSB Bank | Marwan M. Alias | Main |

| Azmi Abd Rahim | Main Support | ||

| 11 | RHB Islamic | Ahmad Mukarrami Ab Mumim | Main |

| Adi Hanif Mohamed | Main Support |